does stimulus check show as tax refund

How the stimulus payments could affect your 2020 tax refund. Tax season has officially begun and a.

Many People Left Waiting For Payments From Irs For Tax Refunds Stimulus Checks Child Tax Credits Cbs Pittsburgh

If you didnt receive the correct amount of stimulus payment you can claim the Recovery Rebate Credit when you file your 2021 taxes and itll provide the same amount of payment as the stimulus would have.

. This is evident in the refund amount. The good news is that stimulus money received last year wont increase tax bills this spring. Only the refundable credit on line 30 is changed to reflect the amount of stimulus you.

If you received any stimulus check or got a direct deposit of economic impact payments EIP or through a stimulus EIP Debit card a question may hover if the payment will actually increase your tax or reduce your expected tax refunds during the year 2021. If youve correctly claimed the Recovery Rebate Credit the IRS will add the money youre due to your 2020 tax refund. He says if you tell an online tax program you did not receive a stimulus check it assumes you did not receive yours and automatically gives you an extra 1200 in your refund or an extra 2400.

If you need help sorting out this or any. Recover missed stimulus payments on 2020 tax returns. Latest on push for one group to get 4th stimulus check If youre getting ready to file your 2021 tax return click here for steps you can take to make filing easier.

Does Stimulus Check Show As Tax Refund. This also works in reverse. The check will come in the mail in either August or September The governor said this money will be a tax refund that residents get by Sept.

If you dont get the full amount that you were entitled to from the first or second stimulus payments you could also get that. The second round of stimulus checks is based on the adjusted gross income on your 2019 tax return which means if you are due more than what you receive the second time youll also receive that money as a credit via your 2020 tax refund. The plain and simple answer to that question is that stimulus payments are tax-free.

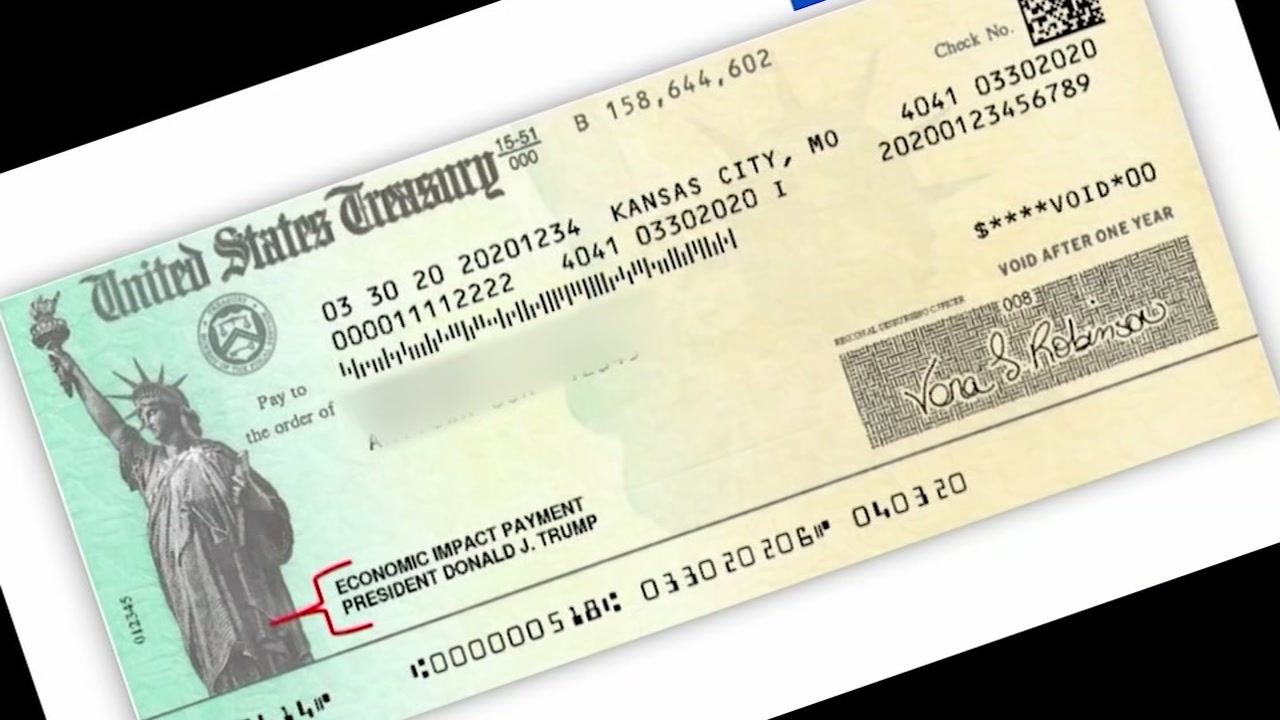

The COVID stimulus checks sent out in 2020 and 2021 will no affect income tax refunds though some taxpayers may be determined to have been owed one which could lead to higher refunds. Bonus one-time stimulus check of 500 375 or 250 in tax refunds for millions taxpayers in this state. For example the stimulus payment is coded in the transaction section as two transaction codes that note a tax relief credit and refund issued These two entries constitute the stimulus payment but they can confuse taxpayers because of.

Tax season has officially begun and many have questions about claiming a stimulus check as part of their IRS refund. Direct deposits are labeled. Dont report stimulus checks as income says Jeremiah Barlow head of family wealth services.

A NEW bill has been signed to provide a tax refund for residents in Georgia. So if your refund was set to be 1000 and youre owed another 1800 from missing stimulus checks youll get 2800 total. If an income tax return has Earned Income Tax Credit or Child Tax Credit the processing will be delayed by two to three weeks.

These are the ones the government will give you a refund for even if youve hit net zero and dont owe anything. The third round of stimulus checks is based on either your 2019 tax return or if you did your tax filing early your 2020 return. Tax information file with World Finance today.

The third stimulus check was issued as an advance Recovery Rebate tax credit for the 2021 tax year. This payment is not included as part of your gross income and as such cannot be taxed. 15 instead of spring 2023 About 31 million residents.

But the stimulus check is the other kind of tax credit. If you qualified for a third stimulus check you could have received up to 1400 for each taxpayer in your household plus 1400 for each dependent. ACH CREDIT IRS TREAS TAX EIP.

If however you filed your 2021 tax return and reported 0 for your recovery rebate credit and you do want to claim more stimulus money you will need to file an amended return using IRS Form 1040 X. It will also not affect an amount you may owe or reduce your tax refund when you file your 2021 taxes. Getting an early start on your taxes can alleviate the stress of tax season and get you.

741 ET Apr 2 2022. 1933 after i put in the two rounds of stimulus checks totalling 3600 it shows federaltax due. 740 ET Apr 2 2022.

Stimulus checks are not taxable but they still need to be reported on 2021 tax returns which need to be filed this spring. The 2021 stimulus checks were disbursed to eligible recipients starting. The main difference between a Stimulus Check and a Recovery Rebate Credit is whether you received it as a check in the mail or will receive it as a tax refund.

If for some reason you didnt get any stimulus payment last year but youre owed one you can get it this year when you file your 2020 tax return by claiming the Recovery Rebate Credit. This first batch of payments totaled about 90 million accounts with a value of more than 242 billion. The IRS said the majority of.

A refundable tax credit like the American Opportunity Tax Credit or Earned Income Tax Credit. However the tax on the return is unchanged as the stimulus payment is not taxable on your return. When you go back and enter the amount you received in stimulus payments the Credit on line 30 is adjusted to reflect the stimulus amount you received.

Only the refundable credit on line 30 is changed to reflect the amount of stimulus you indicated you received.

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc7 Chicago

So There S No Fourth Stimulus Check But You Can Still Get A Child Tax Credit Wkrc

Check Your Address Ahead Of More Stimulus Checks Mymove

Here S The No 1 Thing Americans Do With Their Tax Refund Gobankingrates

Irs Get My Tax Refund Claiming Stimulus Check On 2021 Return Abc7 Chicago

Stimulus Checks Tax Returns 2021

Social Security Recipients Should Expect Stimulus Payment By April 7 Says Irs The Washington Post

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

A Fresh Stimulus Check May Be On The Way To You Thanks To Your Tax Return

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Still Didn T Get Your Stimulus Checks File A 2020 Tax Return For A Rebate Credit Even If You Don T Owe Taxes

Why Stimulus Checks May Appear To Impact Your 2021 Tax Refund Abc11 Raleigh Durham

Third Stimulus Check When Could You Get A 1 400 Check In 2021 Irs Money Sign Prepaid Debit Cards

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How To Get A College Student Stimulus Check 2022

How To Claim A Missing Stimulus Check

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Irs Says Anyone Still Waiting For A Stimulus Payment Should Claim It On Their 2020 Tax Return The Washington Post